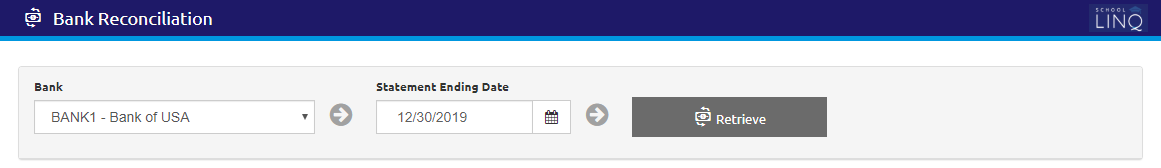

Bank Reconciliation

Bank Reconciliation allows users to perform bank reconciliations.

- Select a bank from the Bank drop-down list.

- Enter or select the Statement Ending Date using the Calendar feature.

- Click the

button. Additional fields will display below.

button. Additional fields will display below.

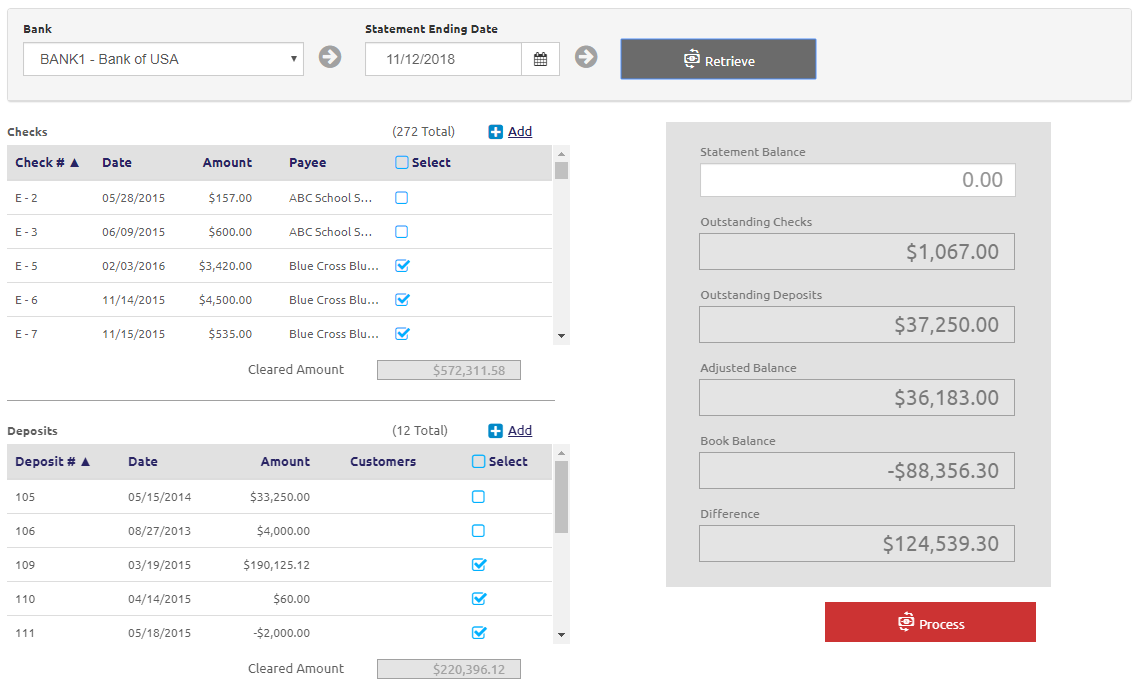

-

Check the boxes next to the Checks or Deposits to clear items, or check the Select box to clear all items.

- Click the

.png) link in the Checks section to add an outstanding check adjustment manually. The Enter Adjustment form will display. The adjustment prints on the outstanding or cleared item reports as an “A” type and does not affect the cash balance or transaction history.

link in the Checks section to add an outstanding check adjustment manually. The Enter Adjustment form will display. The adjustment prints on the outstanding or cleared item reports as an “A” type and does not affect the cash balance or transaction history. - Click the

.png) link in the Deposits section to add an outstanding deposit adjustment manually. The Enter Adjustment form will display. The adjustment prints on the outstanding or cleared item reports as an “A” type and does not affect the cash balance or transaction history.

link in the Deposits section to add an outstanding deposit adjustment manually. The Enter Adjustment form will display. The adjustment prints on the outstanding or cleared item reports as an “A” type and does not affect the cash balance or transaction history.

- Enter

the statement balance in

the Statement Balance field. This is the ending balance from your bank statement.

- The Adjusted Balance will be updated as you clear items.

- The Book Balance is the sum of the cash accounts for this bank as of the statement date selected.

- The Difference between the Adjusted Balance and the Book Balance is automatically calculated. When the difference is zero, the bank account is balanced.

- Click the

.png) button for this Bank Reconciliation to be completed. If the difference does not equal zero, a warning message will display.

button for this Bank Reconciliation to be completed. If the difference does not equal zero, a warning message will display.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021